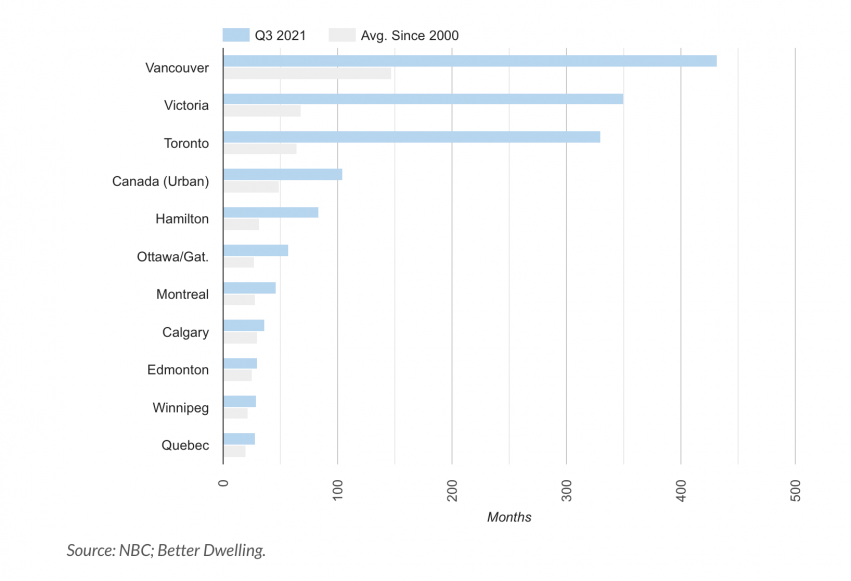

It Now Takes Up To 36 Years To Save A Down Payment For Canadian Real Estate

It’s widely known that Canadian real estate affordability is getting worse. Check out the latest affordability report from National Bank of Canada (NBC). They crunched the numbers on how long it takes to save for the minimum down payment on a non-condo home. As of Q3 2021, it takes double the usual length of time for a median household to save. That’s across the country, with expensive markets taking up to 36 years to save the minimum needed. YIKES!

A Down Payment On Canadian Real Estate Takes 9 Years Of Savings

Canadian households looking to buy a home on the median income need a decade of savings. It takes 104 months (9 years) of savings in Q3 2021 to save the minimum down payment for a non-condo home. To say this is unusual is an understatement. Since 2000, the average has only been 49 months (4 years). It takes more than twice as long as it normally does.

We know, “…but prices won’t stay the same — this is a useless exercise!” That’s the email we get from real estate agents every time we publish National Bank’s estimates. It’s a fair takeaway if you’re not sure what the point the economists are making is.

The metric tells us how long it would take to save a down payment if wages and home prices moved together. It’s a snapshot to highlight where the numbers are if things don’t get worse or better — just where the market is. Markets change and 36 years of consistent growth is unrealistic. They’re just highlighting how far out of historic norms affordability has been.

Vancouver Real Estate Now Takes 36 Years To Save A Down Payment

Vancouver real estate is some of the least affordable on the planet and it somehow found a way to get worse. It takes the median household 431 months (36 years) to save a down payment in Q3 2021. This is up from 410 months in the previous quarter and the average since 2000 is 147 months (12 years). Saving a down payment takes 3 and a half decades, which is 3x worse than normal.

A Toronto Home Takes 28 Years To Save A Down Payment, 5x More Than Normal

Toronto deteriorated even further, which is impressive for North America’s least affordable city. It takes a household 330 months (28 years) to save a down payment in Q3 2021, up from 318 months in the previous quarter. The average since 2000 is just 64 months (5 years), so this is more than 5x longer than normal. This is the second-biggest gap between the market and historic norms across Canada.

Victoria Real Estate Is The Most Disconnected Market In Canada

Victoria gets a special shoutout for the biggest deviation from normal pricing dynamics. It would take 350 months (29 years) to save the down payment on a non-condo home. The average since 2000 is only 68 months (6 years). This is slightly more than the 5x deviation Toronto is seeing.

Edmonton And Winnipeg Are The Only Two Markets Without A Huge Disconnect

Not all Canadian real estate markets are way worse than historic norms. They’re all just located in the Prairie provinces. In Edmonton, it takes 30 months (3 years) to save a down payment in Q3 2021, compared to a 25 month (2 years) average since 2000. Winnipeg came in at 29 months (3 years) compared to 22 months (2 years) using the same measures. They’re both less affordable than usual, but not to the extent of other markets.

Such a large disconnect for home prices doesn’t last forever but it might feel that way. At five years and counting, Canadian real estate is the second-longest bubble in the G7. Not by accident, but Canada expends significant energy inflating prices. It often even labels measures known to raise prices as “affordability measures.”

In fact, financial experts are discussing how parents need to plan to save a down payment for their kids in retirement. Not exactly a discussion that’s typically had in advanced economies.

ARTICLE by: Better Dwelling

Get In Touch

Would you like to chat with someone about buying or selling homes in Calgary? Call, text, or fill out the form below to start your Ken Rigel Group experience. Let’s have coffee! ☕️

Call: 403-207-1748

Email: [email protected]

Knowledgable, flexible, supportive, responsive. Felt like we were working as a team and high level of care.

Thanks for your interest!

Someone will reach out shortly. In the meantime, learn more about our team.