Canadian Real Estate Prices Just Made A Record Price Drop

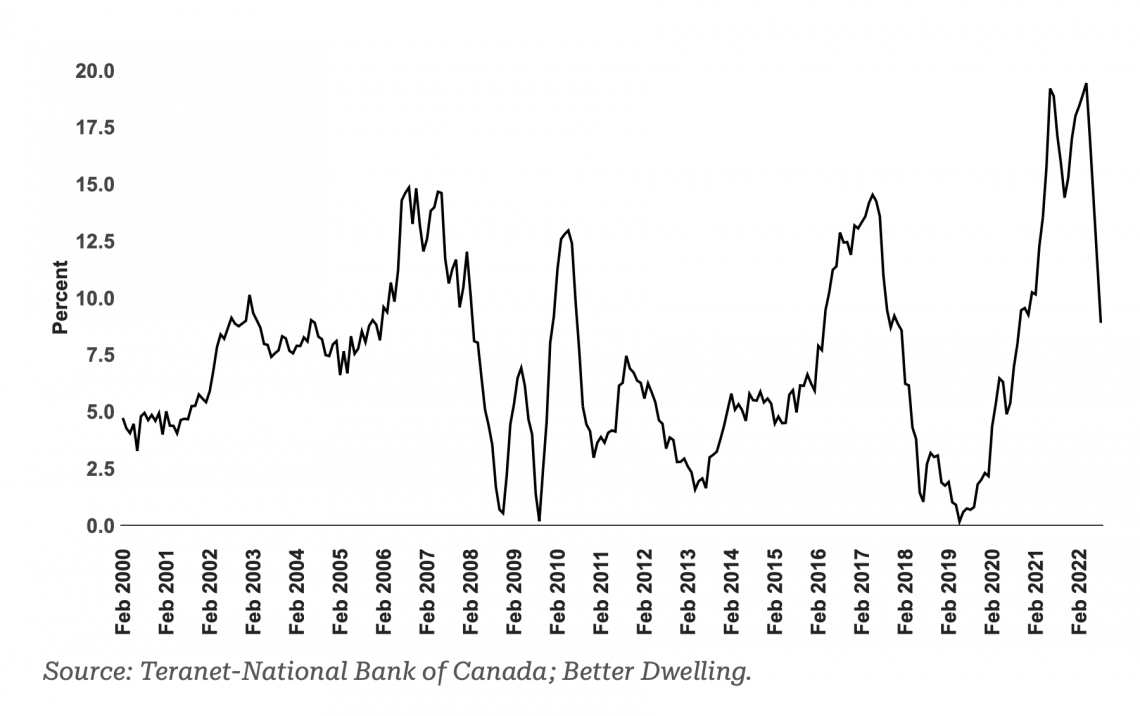

Canadian real estate is making an epic dive according to land registry data. The Teranet–National Bank of Canada House Price Index (HPI) showed a big drop in home prices in August. The index, while conceptually similar to CREA’s HPI, is based on land registry data. That makes it more accurate, as well as comprehensive since it includes all transactions. Teranet-National Bank’s HPI showed the largest price drop in the index, which goes back even further than CREA’s index.

Canadian Real Estate Prices Just Made The Largest Drop Ever

Canadian real estate prices made the largest drop in the history of the HPI. The 11-City HPI fell 2.4% in August, and is down 4.06% from the peak in May 2022. The index hasn’t seen such a substantial monthly drop in the data series, which goes back to 1999.

Canadian Real Estate Price Growth

The annual percent change of Canadian real estate prices for a basket of 11 major markets across the country.

Only Prairie Markets Saw Prices Increase

Major markets that saw prices increase were limited to more affordable regions. By which, we mean Alberta — that didn’t see a boom with the rest of the market. Calgary (+1.3%) and Edmonton (+2.7%) were the two major markets to see growth in Western Canada.

Southern Ontario and Halifax Are The Worst Performing Markets

Negative growth was observed in most markets. National Bank observed the biggest hits in Hamilton (-5.83%), Ottawa-Gatineau (-3.1%), Halifax (-3.6%) and Toronto (-4.0%). It wasn’t at any particular extreme, but Vancouver (-2.0%) fell along with most of BC’s real estate markets.

Canadian real estate is adjusting to a life of higher interest rates, but not nearly as fast as one would think. Mortgage pre-approvals are believed to be propping up buying power, providing lower rates secured up to four months prior. As interest rates hold higher levels for longer, the market is expected to continue adjusting to a higher capital cost.

*Article by Better Dwelling*

Get In Touch

Would you like to chat with someone about buying or selling homes in Calgary? Call, text, or fill out the form below to start your Ken Rigel Group experience. Let’s have coffee! ☕️

Call: 403-207-1748

Email: [email protected]

Knowledgable, flexible, supportive, responsive. Felt like we were working as a team and high level of care.

Thanks for your interest!

Someone will reach out shortly. In the meantime, learn more about our team.