Canadian Mortgage Quality Has “Deteriorated”: Bank Of Canada

(Photo and article courtesy betterdwelling.com)

Canada used to be known for its conservative mortgage lending, but that’s no longer the case. The Bank of Canada (BoC) warned mortgage quality has “deteriorated” in 2020. The central bank found highly indebted households, those with a loan-to-income ratio higher than 450%, now represent a record share of new mortgage debt.

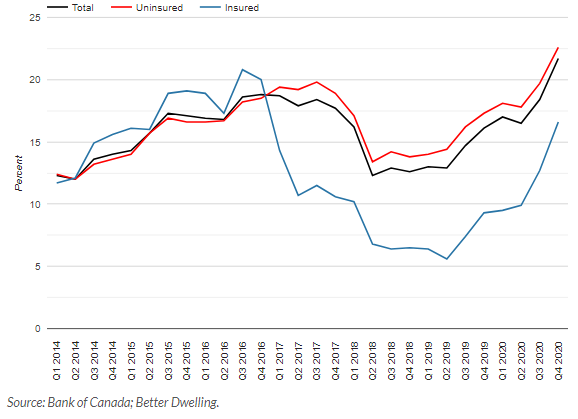

Highly indebted households used to be a small share of mortgage debt. The share surged in 2016/2017, during Toronto and Vancouver’s mini-bubble. Mortgage stress tests were rolled out to lower the share, and it appeared to work. For a while. Now they’re back with a vengeance, with over 1 in 5 new mortgages going to highly indebted households.

Highly Indebted Borrowers Now Behind 22% Of New Mortgage Debt In Canada

The share of newly issued mortgage debt going to highly indebted borrowers surged. These borrowers represent 21.7% of mortgages issued in Q4 2020, a new record high. It dwarfs the previous record set back in Q4 2016 when Toronto and Vancouver had a mini-bubble.

After the stress test, the share dropped to 12.3% of borrowers in Q2 2018. It did start to take off a few quarters before the pandemic. That explains why the pandemic stimulus was so effective in stimulating demand. It was already surging, and they gave borrowers cheaper mortgage debt anyway.

No, you’re not having deja vu. We discussed similar data (down to the same quarter), a few months ago. That was when the industry was examining the issue brewing, and now the BoC is discussing it with the public. They also gave the number of highly indebted insured mortgage borrowers though. So that’s a new data point.

Canadian Mortgage Originations To Highly Indebted Households

The share of mortgage originations to households with a loan to income ratio higher than 450 per cent.

Highly Indebted Borrowers Represent 23% Of Newly Issued Uninsured Mortgages

Breaking the trend down, most of the deterioration is occurring with uninsured mortgages. Highly indebted borrowers represented 22.6% of newly issued mortgage debt in Q4 2020. This is a new record, crushing the previous high — when the share reached 19.8% in Q3 2017.

Post-stress test the share of these borrowers finds the bottom at 13.4% of new mortgages. Worth pointing out that even after the stress test, the share never falls back to 2014 levels. The new normal for risk?

Highly Indebted Borrowers Represent 17% Of Newly Issued Insured Mortgage Debt

Insured mortgages going to highly indebted borrowers are climbing. These borrowers represent 16.6% of newly issued insured mortgage debt in Q4 2020. It’s an elevated level, but still under the 20.8% share seen in the Q3 2016 high. Almost triple the post-stress test low of 5.6% in Q2 2019 though.

The drop (and now surge) of highly indebted mortgage borrowers shows it isn’t just the stress test. It’s an issue of sentiment, and the stress test had a big psychological impact, not a technical one. Back in 2017/2018, Toronto and Vancouver detached homes prices took a nosedive. Fewer people want a big loan if they think there’s a chance of losing money. They can see the risk.

When the pandemic struck, the government didn’t just save the real estate market — they sent it soaring. Homeowners didn’t need to pay their mortgage, interest rates were cut, and QE used to make mortgages even cheaper. The government even outright said it would be unacceptable for home prices to fall. Why would the average person think otherwise?

The moral hazard created now makes it difficult to find a Canadian that thinks home prices can fall. That set off a wave of buyers that no longer see a risk of overpaying, since “prices don’t go down.” They don’t see the risk of overextending themselves, because they think it will always pay off. The only risk they can see is paying more later. After all, the government will try to stop any decline in home prices. Whether they can do so is a totally different story.